Business Insurance in and around Springfield

Springfield! Look no further for small business insurance.

This small business insurance is not risky

Help Prepare Your Business For The Unexpected.

You've put a lot of energy into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a pet groomer, an antique store, a veterinarian, or other.

Springfield! Look no further for small business insurance.

This small business insurance is not risky

Keep Your Business Secure

You are dedicated to your small business like State Farm is dedicated to fantastic insurance. That's why it only makes sense to check out their coverage offerings for commercial liability umbrella policies, builders risk insurance or commercial auto.

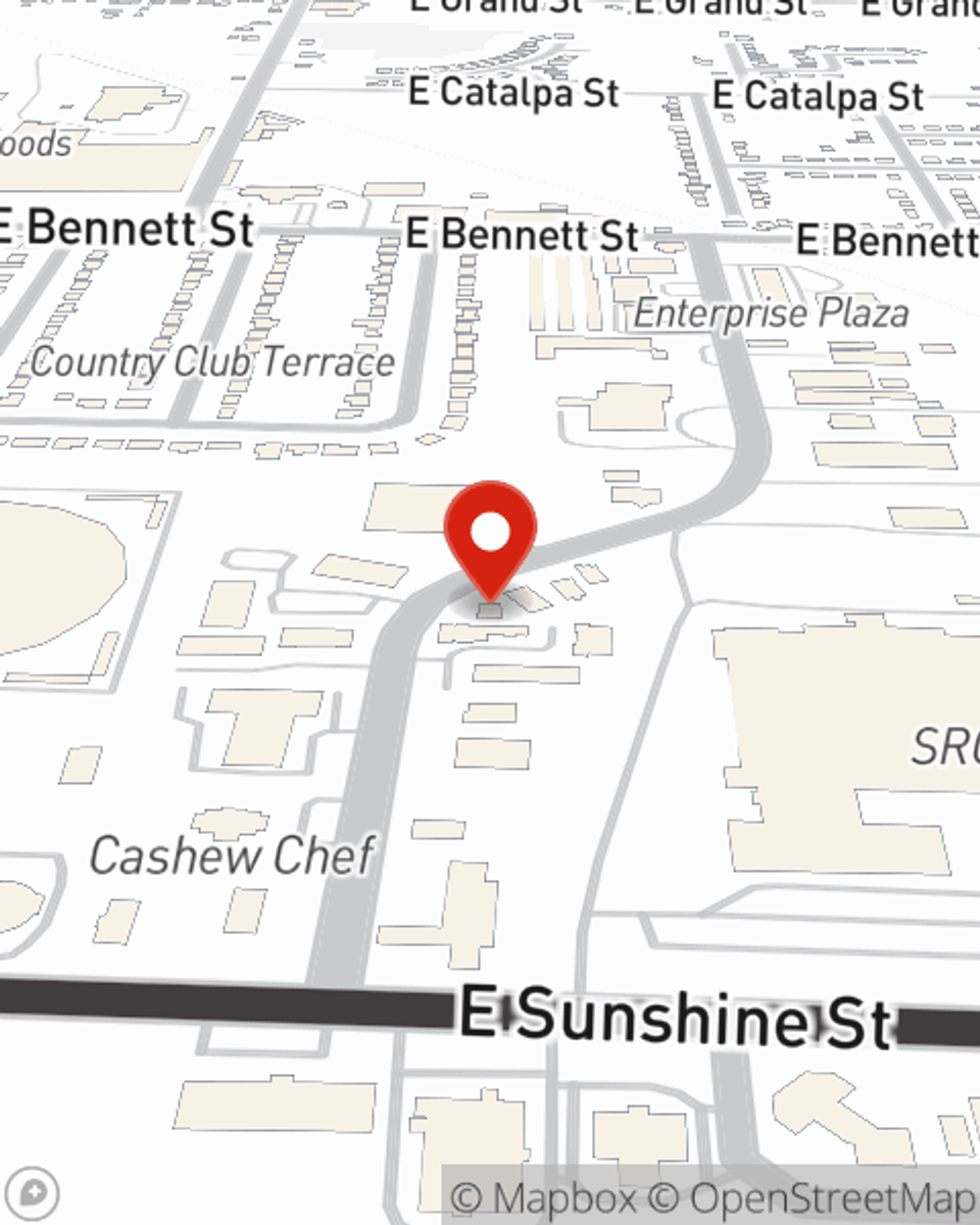

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Jim Roebuck is here to help you review your options. Get in touch today!

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

Jim Roebuck

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.